Imagine being in the middle of a global crisis that causes a downturn in demand — you’re anxious and worried. All you’re thinking is: “Will this dramatic decline continue?”

In such moments, what would you prefer to rely on? A basic statistical measure, or the most advanced AI forecasting that leverages real-world, real-time data?

Let me demonstrate why a model based on real-world, real-time data often significantly outperforms a purely statistical forecast, even when the events themselves are unpredictable.

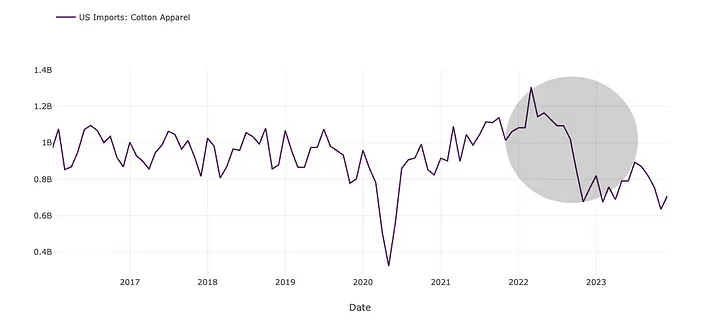

The Decline of Cotton Apparel Imports to the US

The graph below illustrates the import of cotton apparel into the US from around the world. The grey area highlights the significant decrease in imports following the outbreak of the large-scale invasion of Ukraine in February 2022. As we can observe, this decline is historically unusual and is only comparable to the drop experienced in 2020 during the COVID outbreak.

As indicated by the grey area, the most significant shift in this dataset took place within a few months, from September 2022 to November 2022.

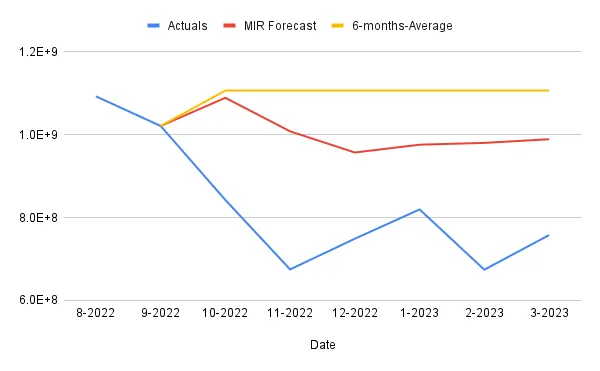

Let’s examine the performance of MIR’s forecast compared to a standard 6-month-average forecasting approach in this context:

The chart above displays forecasts made just before the dramatic decrease occurred, created in September 2022. Here, the MIR forecast (in red) already suggests a decline, whereas the six-month average forecast (in yellow) remains stable and significantly diverges from the actuals (in blue).

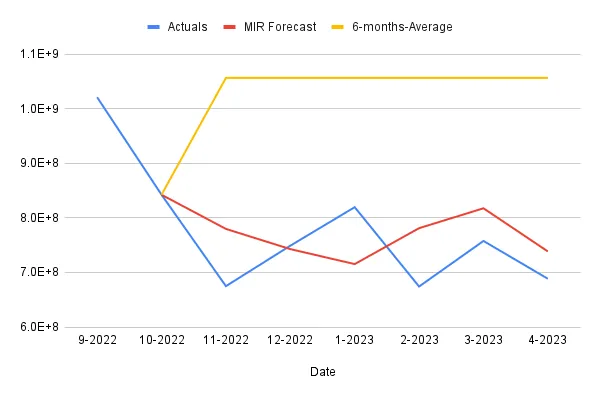

Imagine you’re in the midst of this downturn, feeling anxious and concerned. You’re desperate to know: “Will this dramatic decline continue?” Naturally, you generate another forecast the following month, October 2022.

In the forecast for October 2022, the MIR forecast (in red) accurately predicts the continuation of the downtrend, while the six-month forecast (in yellow) fails to capture the changed reality, as shown by the actual data (in blue).

Overall, the MIR forecast reduces the forecasting error by 70% in this scenario. It has an error margin of 9%, whereas the commonly used six-month average forecast is off by 31%.

Why does MIR outperform and capture trends even in situations of crisis?

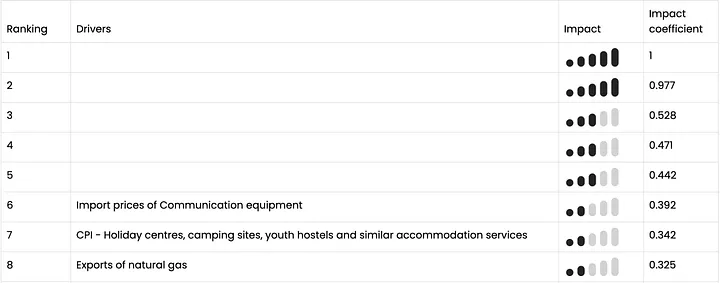

We base our forecast on the following factors:

Our forecast is based on a selection of the most critical influencing factors, automatically identified from billions of pieces of market data. The factors displayed reflect the general price development in imports, influenced by shipping costs. Factors like the inflation of accommodation and natural gas prices depend on energy costs, which were significantly impacted by the crisis.

MIR ‘finds the shoe that fits’ for the dataset we forecast and supercharges forecasting accuracy:

- We connect and source the most promising data sources,

- We set them in contact with the datasets to be forecast,

- We identify which datasets relate to the indicator we want to forecast,

- And we run an AI-model, which experiments with dozens of such market indicators dynamically to find the ideal balance for maximum forecasting accuracy.

What does this mean for my bottom line?

Consider the following:

- Every case is different, but we know that even only one percentage point improvement at a $50 million turnover company can give savings up to $1.52 million (Source). For cotton apparel imports, we brought absolute improvements of 22% and relative improvements of 70%. This is why you should consider advanced forecasting solutions for your business.

- All the hours searching and identifying key early warning indicators? Do you like flipping through irrelevant and expensive market research reports? We take care of that — we find the key indicators for you and forecast them at the same time.

What does this mean for you?

Get in touch via bjol@mirinsight.com if you are interested in finding the early warning indicators in the market that predict your business success and if you are eager to forecast crucial future trends.

Discover how our team of PhDs has been working on a new service to forecast and identify key early warning indicators for your business. For a deeper dive and personalized insights, get in touch with us at bjol@mirinsight.com.

hashtagForecasting hashtagTextiles hashtagBlackSwanEvents hashtagAI hashtagBusinessInsights